.png?width=1800&height=900&name=hedging_partial_withdraw_in_shangai_update(2).png) Partial Withdrawals Post-Shanghai Update: Maximizing Validator Rewards and Hedging with MetalSwap

Partial Withdrawals Post-Shanghai Update: Maximizing Validator Rewards and Hedging with MetalSwap

The Shanghai and Capella update is bringing significant changes to the Ethereum ecosystem (check our previous blogpost if you missed it), including the introduction of partial withdrawals.

This feature allows validators to periodically withdraw rewards earned from staking, providing them with more control over their assets. In this article, we will explore how partial withdrawals work, the potential impact on validator earnings, and how Hedging Swap services like MetalSwap can help manage the risks associated with market volatility.

PARTIAL WITHDRAWALS POST SHANGHAI

Understanding Partial Withdrawals

Partial withdrawals are a new feature in the Ethereum ecosystem, allowing validators to periodically "skim" their validator balances that exceed the 32 ETH threshold. This provides recurring access to the consensus layer (CL) staking rewards their validators have earned. Since the actual balance of an Ethereum validator is limited to 32 ETH, any excess balance is unproductive, making partial withdrawals an efficient way to maximize validator rewards.

Processing Time

Post Shanghai/Capella update, set for the date of the 12th of April, validators can expect their validator's balance to be partially withdrawn every 2-5 days. The range accounts for the uncertainty surrounding how many validators with 0x00 credentials will update to 0x01 credentials immediately after the update. A 2-day processing time assumes none of the validators with 0x00 credentials will upgrade, while a 5-day processing time assumes all of them will upgrade immediately.

Use Case

Consider a validator who staked 32 ETH in the Beacon Chain in 2020. By the time the Shanghai and Capella update arrives, they have accrued about 2 ETH from staking their ETH. With the update, any ETH above 32 (not multiples of 32) will not produce rewards, so the validator would want to withdraw the excess ETH.

To do this, the validator must activate the Sweep key by changing their node key from BLS 0x00 to Execution Layer 0x01. The algorithm processes one block every 12 seconds interval, called a "slot"; 16 requests can be made in each block. Assuming 547,381 active validators, the maximum processing time is 5 days, with an average of 3 days. The withdrawal sweep is automatic and takes about 28 hours, with no transaction costs.

Hedging with MetalSwap

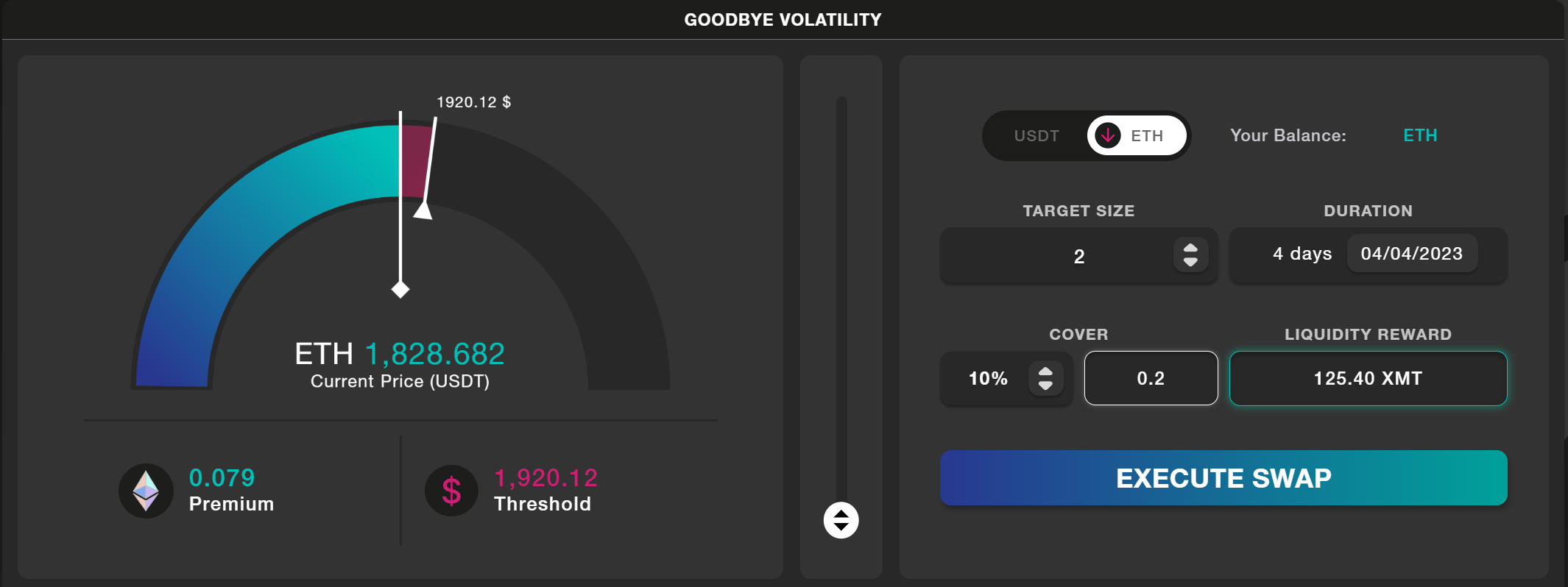

Due to uncertainties regarding the market response to the increased withdrawal possibilities, the validator decides to hedge their position using MetalSwap. They choose coverage for 4 days, targeting a size of 2 ETH and covering 10%. If the price of ETH increases, the validator benefits from the asset's appreciation at the expense of a 0.079 ETH premium and a 0.2 ETH cover, with the option to resettle. If the price of ETH decreases, MetalSwap covers the price gap at the expense of a 0.079 ETH Premium.

At the natural end of the order (Expire Date), there are three scenarios:

- If the price of ETH has been falling slightly, with the hedging position settled for loss direction, your open position is now in profit. You'll gain all the differences between the initial price and the closing price, multiplied by the Target Size. In this scenario, you have effectively locked in a profit and protected yourself from potential losses.

- If the price of ETH increases a bit, will receive profit from the asset appreciation, and the Cover of the Open Position gets eroded accordingly.

-

If the price of ETH increases next to the Threshold, in this case 1920 USDT, the Hedging Position goes Liquidated with the whole Cover eroded. In this case, we can manage the open position meanwhile, while it is open by Adding Liquidity or Closing it manually earlier.

Conclusion

The introduction of partial withdrawals in the Ethereum ecosystem post-Shanghai Update offers validators more flexibility and control over their assets. However, the potential for market volatility necessitates a strategic approach to managing risk. Decentralized hedging swap instruments like MetalSwap provide an effective solution for navigating these uncertainties, allowing validators to protect their digital assets and make informed decisions in the face of market fluctuations.

By incorporating tools like MetalSwap’s Hedging Swaps into their decision-making processes, Ethereum validators can better adapt to the upcoming changes and navigate the challenges posed by increased market volatility.

MetalSwap's Hedging Swap tool allows to hedge against the volatility these events bring.

This is a first article about Shanghai's Update, setting the basis from where we're going to deep-dive into our favourite topics! Stay tuned, Swappers!

To the MetalSwap

… and beyond!

⚠️Warning⚠️

❗ METALSWAP ‘s admins or moderators will NEVER contact you directly on any social under any kind of circumstances.

❗ Everything concerning $XMT ‘s smart contracts and addresses is shared by our official channels (list below), do not trust any different info from any different source.

Goodbye volatility!

- The DeFi Foundation

✎ What is MetalSwap?

With MetalSwap we enable hedging swap transactions through the use of Smart Contracts, AMM style.