The Ethereum ecosystem is about to experience a significant change with the Shanghai and Capella update scheduled for April 12-14th (dates may change). This update is expected to bring about a period of volatility for the Ethereum network, with possible implications for the DeFi sector. In this article, we will briefly discuss the history of Ethereum and what changes the Shanghai Update will bring, before diving into the specifics of withdrawals and how they may contribute to volatility.

A Brief History and What Will Happen

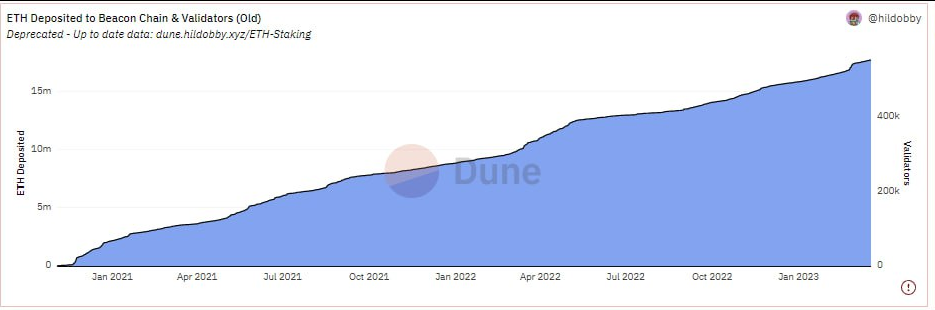

Ethereum was launched in 2015 as a blockchain with a Proof of Work (PoW) consensus algorithm. In November 2020, the Beacon Chain was introduced, laying the groundwork for Ethereum's transition to a Proof of Stake (PoS) consensus algorithm, started with the Beacon chain born where it became possible to stake 32 ETH to which officially took place in September 2022 with The Merge.

Total ETH staked: 17M (14% of the entire supply) in 2 years and 116 days

Total ETH staked: 17M (14% of the entire supply) in 2 years and 116 days

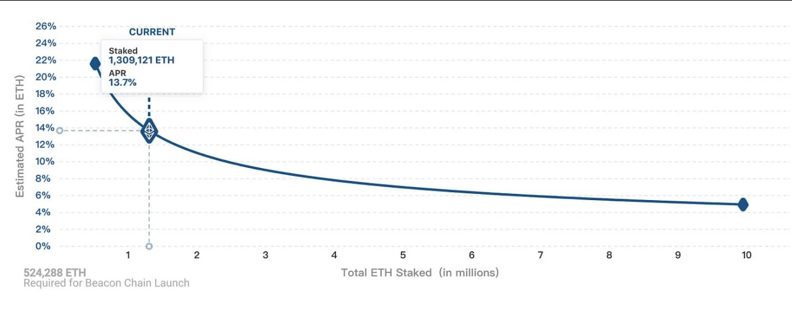

Taking into account the early validators who staked their ETH, it's noteworthy that they have enjoyed an average APY of 6-7% in ETH. Over the course of two years, this has translated to an accumulated profit of more than 15%. As the Shanghai Update introduces more flexibility in withdrawals and staking processes, the experience of these early stakers highlights the potential rewards of participating in Ethereum's staking ecosystem.

Considering the significant appreciation of Ethereum's value (it has more than doubled) since the deployment of the Beacon Chain and the increased flexibility in withdrawals and staking processes offered by the Shanghai Update, it's possible that early validators may choose to take some profits. This highlights the potential rewards and opportunities within Ethereum's staking ecosystem, as validators capitalize on their substantial gains.

APR of staked ETH went from a 22% to an actual 3.9%

The upcoming Shanghai and Capella update will consolidate this transition and make the execution layer (Shanghai) and the consensus layer (Capella) bidirectional.

Now we come to the volatility issue heart: part of those 17M ETH can now be withdrawed and putted on the market.

Understanding Withdrawals in the Shanghai Update

The Shanghai and Capella update introduces three key features related to withdrawals:

- Updating withdrawal credentials from the older 0x00 type (derived from a BLS key) to the newer 0x01 type (derived from an Ethereum address).

- Partial withdrawals or the periodic "skimming" of rewards earned at the consensus level from an active validator's balance (greater than 32 ETH).

- Full withdrawals or the recovery of the entire balance of an 'exited' validator.

Only validators with the latest withdrawal credentials of type 0x01 will be able to benefit from partial and full withdrawals. There will be a single automated withdrawal process for both types of withdrawals, occurring every 12 seconds. Additionally, making a partial or full withdrawal will not involve any gas costs.

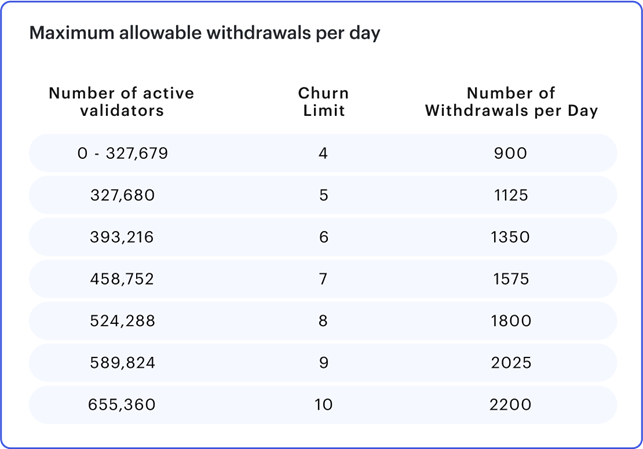

Partial Withdrawals: Expect a 2-5 Day Processing Time

Partial withdrawals allow validators to access rewards periodically by "skimming" their validator balances in excess of 32 ETH. Since an Ethereum validator's actual balance is limited to 32 ETH, any excess is unproductive. Validators can expect their validator's balance to be partially withdrawn every 2-5 days after the Shanghai/Capella update.

The range in processing time depends on how many validators with 0x00 credentials update to 0x01 credentials immediately after the update. Two days assume that none of the validators with 0x00 credentials will upgrade, while five days assume that all validators with 0x00 credentials upgrade immediately.

Full Withdrawals: Expect a 3 to 300+ Day Processing Time

A full withdrawal retrieves the entire balance of an 'exited' validator. The withdrawal process occurs automatically for any validator that has a withdrawal credential of type 0x01 and has exited. In Ethereum, the full withdrawal period is the sum of two processes, each with varying durations: the validator exit process and the complete withdrawal process.

Volatility: The Impact of Withdrawals on Ethereum and DeFi

With the Shanghai Update, long-term stakers will gain access to funds that have been locked for more than two years. By reducing the liquidity risk of ETH staking, withdrawals could inspire confidence in liquid staking protocols and make ETH staking a more attractive opportunity in general. However, many stakeholders will be returning to their ETH and rewards accumulated after as much as two years, which could bring a period of volatility for ETH.

Furthermore, we are likely to see an increase in the flow of liquid staking tokens into DeFi protocols as confidence in these tokens and competition between their issuers increases (see the use case of Lido, for example).

Conclusion

The Shanghai and Capella update is a significant event for Ethereum, and its impact on the staking ecosystem and DeFi sector cannot be understated. The introduction of partial and full withdrawals will offer stakers more flexibility and control over their assets, which could lead to an increase in Ethereum's overall attractiveness as a staking platform.

However, as more stakers gain access to their locked funds and accumulated rewards, the market may experience a period of volatility. This may be further exacerbated by the increased flow of liquid staking tokens into DeFi protocols, potentially causing fluctuations in token prices and the overall DeFi landscape.

As we approach the Shanghai Update, it is crucial for Ethereum holders, validators, and DeFi participants to stay informed and be prepared for the potential volatility that may arise. By understanding the implications of the update and the new withdrawal mechanisms, the Ethereum community can navigate this period of change with confidence and continue to build on the platform's growing success.

Moreover, learning how to manage volatility will be of strategic importance during this time. MetalSwap is a tool designed to help users make informed decisions in volatile markets by reducing risk and providing valuable insights. By incorporating tools like MetalSwap’s Hedging Swaps into their decision-making processes, Ethereum stakeholders can better adapt to the upcoming changes and navigate the challenges posed by increased market volatility.

MetalSwap's Hedging Swap tool allows to hedge against the volatility these events bring.

This is a first article about Shanghai's Update, setting the basis from where we're going to deep-dive into our favourite topics! Stay tuned, Swappers!

To the MetalSwap

… and beyond!

-The DeFi Foundation

⚠️Warning⚠️

❗ METALSWAP ‘s admins or moderators will NEVER contact you directly on any social under any kind of circumstances.

❗ Everything concerning $XMT ‘s smart contracts and addresses is shared by our official channels (list below), do not trust any different info from any different source.

✎ What is MetalSwap?

With MetalSwap we enable hedging swap transactions through the use of Smart Contracts, AMM style.