Today, we will continue our journey of exploring the Conceptual Development Map that we introduced a few weeks ago. Our focus today will be on the category of Scaling Hedging Swap, where we will delve into understanding the various possibilities for enhancing the scalability of the tool. It is worth noting that the DAO's recent decision to incorporate the Hedging Swaps of MetalSwap on the Optimism blockchain was a significant advancement in this area. However, we believe there is more to explore and accomplish. Therefore, let us prepare ourselves for this in-depth exploration!

Conceptual Map - Scaling Hedging Swap

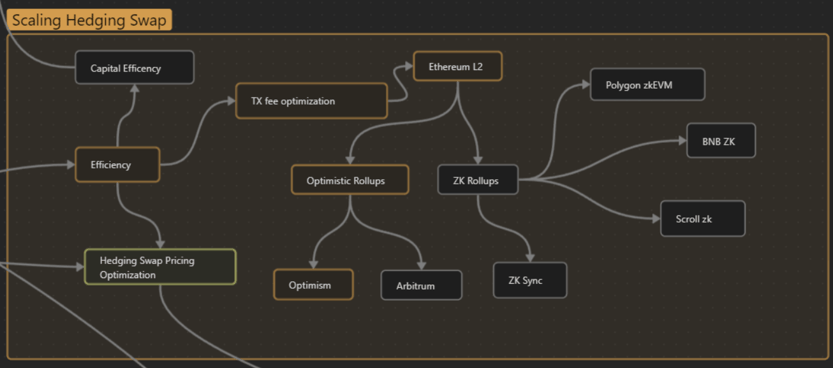

We’d like to remind you that the coloured boxes on the map represent features that have already been implemented in the MetalSwap dApp. On the other hand, the non-coloured boxes represent topics that are currently under research and development and are not yet part of the dApp.

Why does MetalSwap need to scale its Hedging Swap?

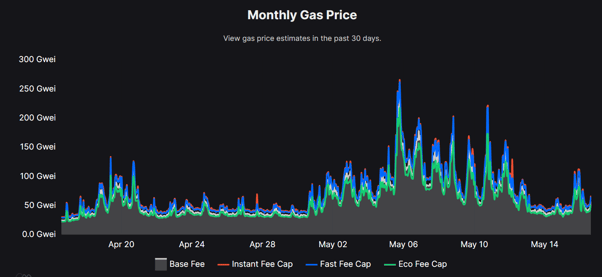

Ethereum Gas Price

As you may have noticed, in recent weeks, we have experienced a significant surge in Ethereum gas fees. This increase in fees translates to higher costs for opening a hedging swap on the MetalSwap dApp. Currently, with gas prices hovering around 200 Gwei, a single operation can incur fees of over $200. Given this situation, the DAO has come to the decision that it is necessary for MetalSwap to adopt a Layer 2 solution.

Similar to our previous episode in this series, where we analysed the Digital Assets Area, we will now examine what has already been implemented on the dApp. Subsequently, we will explore the ongoing research and development initiatives.

What was already implement

As indicated on the map, our current focus is on optimizing transaction fees. This objective will be achieved by integrating the hedging swap functionality with a Layer 2 technology on the Ethereum blockchain. Among the available L2 solutions, the DAO has chosen the rollups approach, particularly the Optimism Blockchain. Recently, there was a vote within the MetalSwap DAO regarding the integration of the Hedging swap on the Optimism Blockchain, and the outcome of the vote was positive. Therefore, in the coming days, we will witness the introduction of these new features.

In comparison to Ethereum gas fees, the average fees on Optimism are significantly lower, typically around $1 or $2 per transaction. This will also have a direct impact on the premium requests for open a hedging swap, as the liquidity system on this blockchain is more efficient.

Furthermore, transactions on Ethereum Layer 2 will experience another cost reduction after the implementation of the EIP-4844 upgrade, better known as Proto-Danksharding. This upgrade will enhance efficiency and significantly reduce transaction costs on these secondary blockchains like Optimism.

Another important change that will take place on the Optimism blockchain in the next few days, precisely on June 6, 2023 is the bedrock upgrade. Thanks to it, this blockchain will experience a significant reduction in transaction fees, increased network security and improved compatibility with Ethereum.

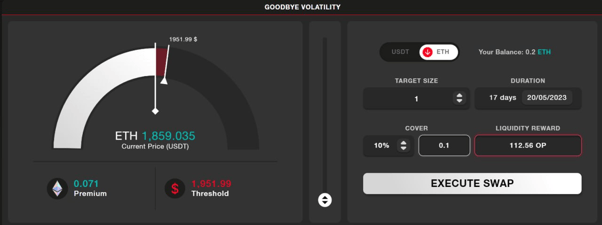

MetalSwap OP Dapp

What's coming up in this area?

The alternative solution to Optimism was Arbitrum, which is similar in nature. However, due to the grant received from Optimism, MetalSwap DAO decided to choose Optimism over Arbitrum. This does not mean that the DAO will never consider to deploy in another chain in the future. However, in order to keep liquidity efficient, it is currently best not to split it between different blockchains.

Another significant topic in this area is Zk Rollups, which refers to Zero Knowledge Rollups, a revolutionary Layer 2 system. In recent months, there has been a surge in the popularity of Zk Rollups, with ZK Sync being one of the most well-known implementations currently. Other important Zk Rollups that the team is looking for in the next implementation are BNB ZK, Scroll zk and the Polygon zkEVM.

However, one issue with ZK Rollups at the moment is their limited support for oracles, which is a crucial feature for MetalSwap. The team is currently waiting for the oracles ecosystem to improve and become sufficient to make the implementation possible.

Another important issue is that all this kind of Layer 2 are very recent and for this reason the liquidity and the security on them is not enough yet to bring the MetalSwap smart contracts.

Conclusion

To achieve ever-increasing volumes, MetalSwap needs to bring its hedging swaps to more efficient and cost-effective blockchains than Ethereum, without compromising on high-security standards. The first step in this direction is the integration with the Optimism blockchain, made possible in part by the received grant. However, MetalSwap does not intend to stop there. The team encourages all Swappers to share their ideas on the next scalability solutions within the project's official forum.

Join this revolution!

Goodbye Volatility

To the MetalSwap!

… and beyond

-The DeFi Foundation

⚠️Warning⚠️

❗ METALSWAP ‘s admins or moderators will NEVER contact you directly on any social under any kind of circumstances.

❗ Everything concerning $XMT ‘s smart contracts and addresses is shared by our official channels (list below), do not trust any different info from any different source.

✎ What is MetalSwap?

With MetalSwap we enable hedging swap transactions through the use of Smart Contracts, AMM style.